Buy AMD Stocks: Unlocking Potential of Advanced Micro Devices

Table of Contents

Introduction: Why Buy AMD Stocks?

If you’re considering entering the stock market, one term you’ve probably encountered is “buy AMD stocks.” Advanced Micro Devices, better known as AMD, is a prominent player in the tech industry. Buying AMD shares could be a smart move for investors looking toward the future.

AMD stock has garnered significant attention due to its innovation in the semiconductor industry and impressive stock performance. This post explores why you might want to invest in AMD, how you can buy its shares, and what to expect regarding AMD stock projections.

Understanding AMD and Its Market Position

Before diving into why buying AMD stocks could be a strategic investment, let’s understand what makes AMD stand out:

- Innovative Products: AMD is recognized for its cutting-edge processors and graphics cards. This positions the company as a strong competitor against the likes of Intel and NVIDIA.

- Market Growth: With the increasing demand for high-performance gaming and computing, AMD stocks symbolize a firm investment in a growing tech market.

- Robust Financials: AMD’s consistent financial growth and investments in new technologies make its stocks a viable option for both new and seasoned investors.

Understanding AMD’s Market Position

AMD’s Core Business and Products

Advanced Micro Devices (AMD) is a leading semiconductor company that designs and produces a wide range of high-performance computing and graphics solutions. Their core business revolves around two main segments:

- Computing and Graphics

- Enterprise, Embedded, and Semi-Custom

AMD’s product portfolio includes:

- Central Processing Units (CPUs)

- Graphics Processing Units (GPUs)

- Accelerated Processing Units (APUs)

- System-on-Chip (SoC) solutions

- Field-Programmable Gate Arrays (FPGAs)

| Product Category | Key Product Lines |

|---|---|

| CPUs | Ryzen, EPYC |

| GPUs | Radeon |

| APUs | Ryzen with Radeon Graphics |

| SoCs | Custom solutions for gaming consoles |

| FPGAs | Xilinx Adaptive SoCs |

Competitive Landscape in the Semiconductor Industry

AMD operates in a highly competitive industry, facing off against tech giants such as:

- Intel Corporation: AMD’s primary competitor in the CPU market

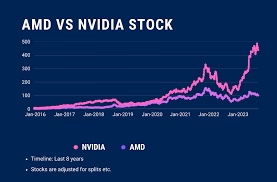

- NVIDIA Corporation: Main rival in the GPU sector

- Qualcomm and ARM: Competitors in the mobile and embedded markets

Despite fierce competition, AMD has managed to carve out a significant market share through innovation and strategic partnerships.

Recent Performance and Market Share Gains

In recent years, AMD has experienced remarkable growth and market share gains:

- CPU Market: AMD’s Ryzen processors have gained substantial market share from Intel, particularly in the desktop and server segments.

- GPU Market: While still trailing NVIDIA, AMD’s Radeon GPUs have seen increased adoption in both gaming and professional markets.

- Console Gaming: AMD powers the latest generation of gaming consoles from Sony (PlayStation 5) and Microsoft (Xbox Series X/S).

Future Growth Prospects

AMD’s future growth prospects appear promising, driven by several factors:

- Continued innovation in CPU and GPU technologies

- Expansion in the data center and enterprise markets

- Growing demand for high-performance computing solutions

- Potential opportunities in emerging technologies like AI and machine learning

The company’s acquisition of Xilinx in 2022 has further strengthened its position in the FPGA market, opening up new avenues for growth in areas such as 5G infrastructure, automotive, and industrial automation.

As we delve deeper into AMD’s potential as an investment, it’s crucial to examine the company’s financial health. This analysis will provide a clearer picture of AMD’s ability to capitalize on its market position and future growth opportunities.

How to Buy AMD Shares

Interested in investing in AMD? Here’s a simple guide to help you buy AMD shares:

- Choose a Brokerage: Start by selecting a brokerage platform that offers Advanced Micro Devices stock.

- Open an Account: Most brokerages allow you to open an account online. You’ll need to provide personal information and link a bank account.

- Research AMD Stock Prices: Use tools provided by your brokerage to assess AMD stock prices today and decide the best time to invest.

- Place Your Order: Select the amount of AMD stock you wish to purchase. You can buy shares directly or opt for fractional shares, depending on your budget.

- Monitor Your Investment: Keep an eye on AMD stock rates and news affecting its performance to make informed adjustments.

AMD Stock Predictions and Projections

Many investors are curious about AMD stock projections and how they might influence their portfolio. Here are some current predictions and factors affecting AMD’s future:

- Future Growth: With AMD’s ongoing investments in AI and 5G, there is a positive outlook for the AMD stock future.

- Market Trends: Analysts predict a steady rise in AMD stock prices, driven by demand in technology sectors like cloud computing and enterprise services.

- Potential Risks: Although AMD shows promise, it’s vital to consider potential risks such as market competition and economic fluctuations.

Monitoring AMD Stock Prices: Today and Tomorrow

Keeping abreast of AMD stock prices is crucial for strategic investing:

- Use Financial Apps: Apps like Yahoo Finance or your brokerage app can provide real-time updates on AMD stock prices today.

- Set Alerts: Customize stock alerts for significant changes in AMD share prices to facilitate timely investment decisions.

- Follow Market News: Regularly engage with news sources that cover AMD developments and stock market news.

Strategies for Buying AMD Stock

Now that we’ve evaluated AMD’s stock valuation, let’s explore effective strategies for buying AMD stock. These approaches can help you make informed decisions and potentially maximize your returns.

A. Dollar-cost averaging approach

Dollar-cost averaging (DCA) is a popular strategy for investing in stocks like AMD. This method involves investing a fixed amount of money at regular intervals, regardless of the stock’s price. Here’s why DCA can be beneficial:

- Reduces the impact of market volatility

- Helps avoid emotional decision-making

- Allows for consistent investment over time

| Pros of DCA | Cons of DCA |

|---|---|

| Mitigates timing risk | May miss out on larger gains |

| Simplifies investing process | Requires discipline and patience |

| Works well for long-term investors | May incur more transaction fees |

B. Timing your entry based on market conditions

While timing the market perfectly is challenging, considering market conditions can help you make more informed decisions when buying AMD stock. Consider the following factors:

- Overall market trends

- Semiconductor industry cycles

- AMD’s product release schedule

- Earnings report dates

Keep in mind that attempting to time the market can be risky and may lead to missed opportunities.

C. Considering options trading for advanced investors

For experienced investors, options trading can provide additional strategies for investing in AMD stock. Some popular options strategies include:

- Covered calls

- Protective puts

- Bull call spreads

- Cash-secured puts

Remember that options trading carries higher risks and requires a deeper understanding of market mechanics.

D. Diversifying within the tech sector

While AMD can be an attractive investment, it’s crucial to diversify your portfolio. Consider these approaches:

- Invest in AMD’s competitors (e.g., Intel, NVIDIA)

- Explore related industries (e.g., cloud computing, AI)

- Consider tech-focused ETFs that include AMD

Diversification can help mitigate risks associated with investing heavily in a single stock or sector.

When implementing these strategies, it’s essential to consider your financial goals, risk tolerance, and investment horizon. Regular monitoring and rebalancing of your portfolio are crucial to ensure your AMD investment aligns with your overall investment strategy.

As we move forward, we’ll discuss the importance of monitoring your AMD investment to make informed decisions about holding, selling, or increasing your position in the company.

Monitoring Your AMD Investment

Now that you’ve invested in AMD stock, it’s crucial to stay vigilant and monitor your investment regularly. This ongoing process ensures you’re well-informed about the company’s performance and can make timely decisions regarding your investment.

Key metrics to track

When monitoring your AMD investment, focus on these essential metrics:

- Revenue growth

- Gross margin

- Operating margin

- Earnings per share (EPS)

- Price-to-earnings (P/E) ratio

- Market share in key segments

| Metric | Importance | What to Look For |

|---|---|---|

| Revenue growth | High | Consistent year-over-year increase |

| Gross margin | Medium | Steady improvement or stability |

| Operating margin | High | Gradual increase over time |

| EPS | High | Positive growth trend |

| P/E ratio | Medium | Comparison with industry average |

| Market share | High | Gains in CPU and GPU markets |

Regularly reviewing these metrics will give you a comprehensive view of AMD’s financial health and market position.

Following AMD’s product announcements and launches

Staying informed about AMD’s product pipeline is crucial for understanding the company’s future potential. Keep an eye on:

- New CPU and GPU releases

- Advancements in data center and enterprise solutions

- Partnerships with major tech companies

- Performance benchmarks against competitors

These announcements can significantly impact AMD’s stock price and market perception.

Staying informed about industry trends and news

The semiconductor industry is dynamic and highly competitive. To effectively monitor your AMD investment, stay updated on:

- Global chip shortages or supply chain issues

- Technological advancements in the industry

- Competitor moves and product launches

- Regulatory changes affecting the tech sector

Industry news can provide valuable context for interpreting AMD’s performance and future prospects.

Reassessing your investment thesis regularly

As market conditions and AMD’s position evolve, it’s essential to revisit your original investment thesis. Consider:

- Has AMD’s competitive advantage strengthened or weakened?

- Are the company’s growth projections still realistic?

- Have any new risks emerged that could impact AMD’s performance?

- Does the current stock price align with your valuation expectations?

By regularly reassessing your investment thesis, you can make informed decisions about whether to hold, buy more, or sell your AMD shares.

Remember, successful investing requires ongoing attention and analysis. By diligently monitoring these aspects of your AMD investment, you’ll be better equipped to navigate the risks and rewards of owning AMD stock. As we move forward, it’s important to adapt your investment strategy based on the insights gained from this continuous monitoring process.

Conclusion: Is Buying AMD Stocks a Good Investment?

In summary, buying AMD stocks could be an excellent investment for those interested in the tech sector. Given AMD’s stable market position and consistent growth projections, investing in AMD may offer significant rewards. However, it’s important to stay informed and understand the dynamics of the stock market. Always conduct your own research or consult with a financial advisor to determine the best strategy tailored to your financial goals.

Consider starting your journey to buy AMD stocks today and become part of a promising future in technology. Want to learn more about the stock market? Explore our guide to smart investing for comprehensive insights.